Companies in a fix

LIVINGSTONE MARUFU

The Reserve Bank of Zimbabwe (RBZ) is planning to provide local businesses that have not received their allocated hard currency—estimated to be in the millions of dollars—from the foreign currency auction trading system with a two-year ZiG instrument, a condition which is detrimental to business, Business Times can report.

Adding insult to injury, exporters will also get a one-year ZiG instrument from the Treasury for the 25% of export earnings they have to surrender to the Ministry of Finance, Economic Development and Investment Promotion.

It follows the central bank’s decision to discontinue running the forex auction system.

The local businesses have been badly damaged by the development.

The crux of the matter is that these businesses were compelled to surrender the Zimbabwe dollar equivalent to the central bank in advance.

This has forced the frustrated companies to source the greenback from the black market, where the premiums are punitive.

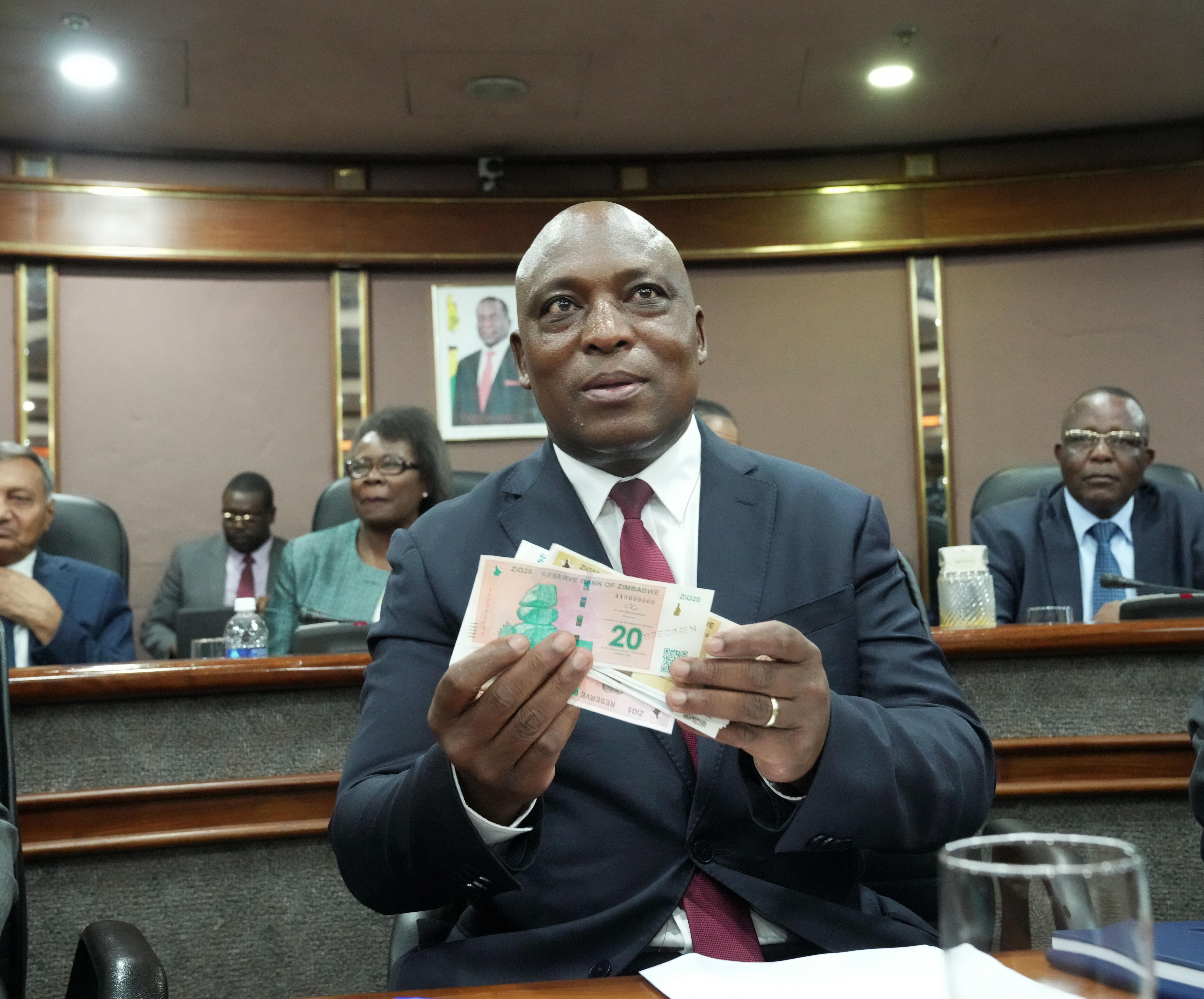

RBZ governor, Dr John Mushayavanhu, confirmed the plan to issue a two year ZiG denominated instrument at an interest rate of 7.5% per annum.

He said this process will allow the beneficiaries to maintain the value of their proceeds under the new framework.

He also said all outstanding payments for foreign exchange purchased by Treasury under the 25% surrender requirement will be converted to a ZiG denominated instrument with a tenor of one year at an interest rate of 7.5% per annum.

“ Following the establishment of a refined interbank foreign exchange market, all outstanding auction allotments will be converted into ZiG and refunded to recipients at the current interbank exchange rate. This will allow the new system to start on a clean slate using the interbank foreign exchange system. The refund will entail conversion of all outstanding auction allotments into a two – year ZiG denominated instrument at an interest rate of 7.5% per annum,” Dr Mushayavanhu.

He added: “This process will allow the beneficiaries to maintain the value of their proceeds under the new framework.

“All outstanding payments for foreign exchange purchased by Treasury under the 25% surrender requirement will be converted to a ZiG denominated instrument with a tenor of one – year at an interest rate of 7.5% per annum.

Business is frustrated.

The president of the Zimbabwe National Chamber of Commerce (ZNCC), Mike Kamungeremu, stated that the central bank ought to move swiftly to prevent the businesses from having to operate at reduced capacity and from facing lawsuits from clients , which could affect confidence in the brands.

“We have a great deal of foreign currency that we are owed, some members have borrowed the money from banks, some received advance payments from customers and they are still waiting for delivery of goods.

“Some customers are threatening to sue them. Some are saying the 12 to 24 months are too heavy for them, therefore, we would like you to look at it again.

“Also, we have the exporters who feel that the 12 months is too long for them hence we would appreciate it if you address it as quickly as possible,” Kamungeremu said.

He added: “As you know, we are in a difficult position right now given various headwinds in the economy hence we need an urgent payment to ensure smooth flowing of the operations. Some of our members are owed as back as the start of November 2023, given that situation companies are strained as they depend with that money for day to day running of the companies.

“The thing is that a company would have taken all the Zimbabwe dollars to buy the United States dollars on the auction but with no payment over a period of over 90 days means the company will have a huge hole in its coffers.”

Kurai Matsheza, president of Confederation of Zimbabwe Industries (CZI) concurred with Kamungeremu.

“We are certainly not happy with the time the authorities have taken to clear the backlog and also the time they are suggesting to settle the bill as this will affect our trust with consumers who have already paid.

“Also this will weaken working capital for the companies that are owed,” Matsheza said.

He stated that although CZI is in dire need of the money, they are working with RBZ to find likely solutions with the authorities.

” We have a number of ideas we have brought forward to the authorities and wde hope the monetary authorities would accept the new proposals we have put on the table,” Matsheza said.

Responding to the business community, new RBZ boss said the bank was open to dialogue with business.

“We have heard what the businesses have said and we will look into the matter and see what we can come up with from the discussions,” Dr Mushayavanhu said.