Chinese telecommunications equipment maker Huawei Technologies is making business resilience its top priority with a push to develop its software capabilities as it seeks to overcome US restrictions that have devastated its smartphone business.

Huawei was put on an export blacklist by former US President Donald Trump in 2019 and barred from accessing critical technology of US origin, affecting its ability to design its own chips and source components from outside vendors.

The ban put Huawei’s handset business under immense pressure.

The company harbours “no expectation” of being removed from the Entity List under the administration of US President Joe Biden, and is now looking to develop other lines of business after spending the last year in survival mode, the company’s rotating chairman Eric Xu said on Monday.

“We cannot develop our strategy based on either a groundless assumption or on unrealistic hopes, because if we do that, and if we cannot be taken off from the Entity List, it’s going to be extremely difficult for the company,” Xu said in a Q&A on the launch of the company’s annual summit for analysts.

Taking on Tesla

The company will invest more in businesses that are less reliant on advance process techniques, Xu said, highlighting the company’s intelligent driving business, in which he said the company would invest more than US$1-billion this year. The company’s autonomous driving technology allows cars to travel over 1 000km, overtaking Tesla in that area, Xu said.

He said Huawei was working with three domestic car makers on sub-brands that will be designated “Huawei Inside” models. In February, Reuters reported that Huawei planned to make electric vehicles under its own brand, which Huawei denied.

Xu said that US action against Huawei had damaged trust across the semiconductor industry, and contributed to global chip shortages as Chinese companies rushed to stockpile three to six months worth of semiconductors last year, fearing similar action against them.

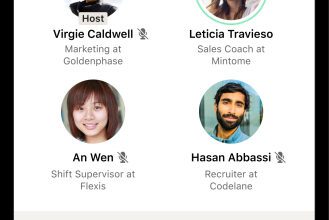

Huawei’s Eric Xu

The combined demand from the Chinese market for chip supplies that are not affected by US rules or which could be compliant with US rules would lead companies to invest in chips and also eventually supply Huawei, Xu said. “If that can be done, and if our inventory level can help Huawei to last to that time, then that will help us to address the problems and challenges we face.”

Xu also said the global roll-out of 5G telecoms networks had “exceeded expectations”.

Last year, the company saw a modest 3.2% rise in its annual profit as overseas revenues declined due to pandemic-related disruption and the impact of the US sanctions, it said last month. — Reported by David Kirton, (c) 2021 Reuters